Japan's future as seen by leading domestic investors 2025 by JVCA

Against the backdrop of a rapidly changing global landscape and accelerating technological innovation, Japan's startup ecosystem is reaching a critical inflection point. What are the latest investment trends, global developments, Japan's competitive advantages, and the indispensable strategies for pioneering the future, as observed by Japan's leading venture capitalists? Incorporating key trends for 2025–2026, they will offer sharp perspectives on the future of Japanese industry and the economy.

The Untold Truth About Startups and Banks — How to Leverage Banking Relationships for Faster Growth

Banks are familiar yet often challenging partners for startups. This session offers a candid discussion aimed at breaking down the invisible wall between the two. From multiple perspectives, speakers will share practical insights you won’t find in textbooks — including how to approach debt negotiations effectively, how to leverage non-lending assets like customer networks and credibility, and what banks are really expecting — or concerned about — when working with startups. For founders and CFOs looking to turn their bank relationships into a strategic lever for growth, this is a must attend session.

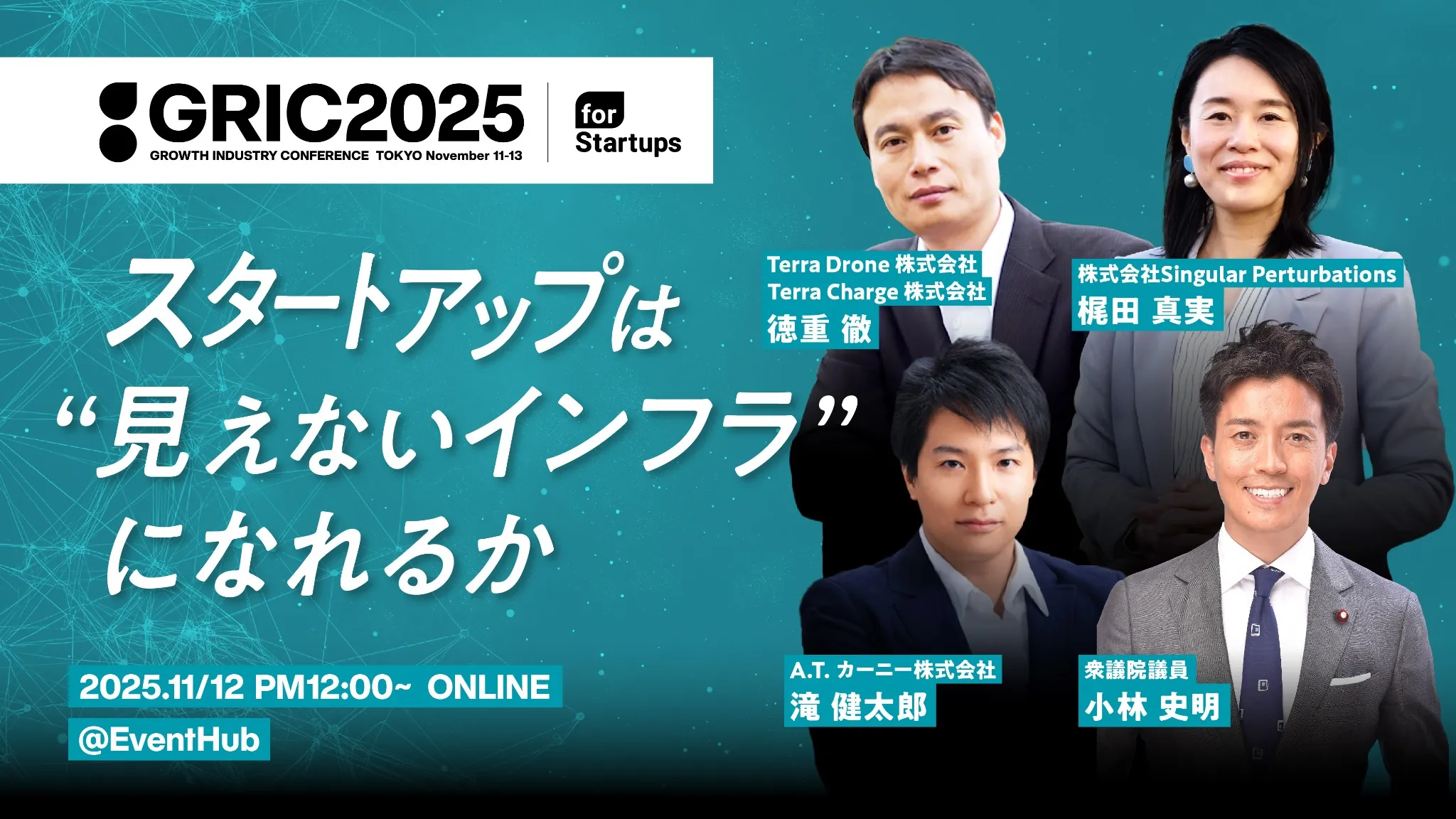

Can Startups Become the Invisible Infrastructure of Society?

Can startups become the “invisible infrastructure” that supports society and national security? Focusing on economic security, technological sovereignty, and dual-use innovation, this session explores the role of private technologies in fields such as satellites, cybersecurity, and drones. Speakers include Mr. Taki of Kearney, Mr. Kobayashi of the Liberal Democratic Party, Mr. Kajita of Singular Perturbations, and Mr. Tokushige of Terra Drone. Together, they will discuss—through the lenses of both policy and industry—the real challenges facing startups and the strategies Japan must pursue.

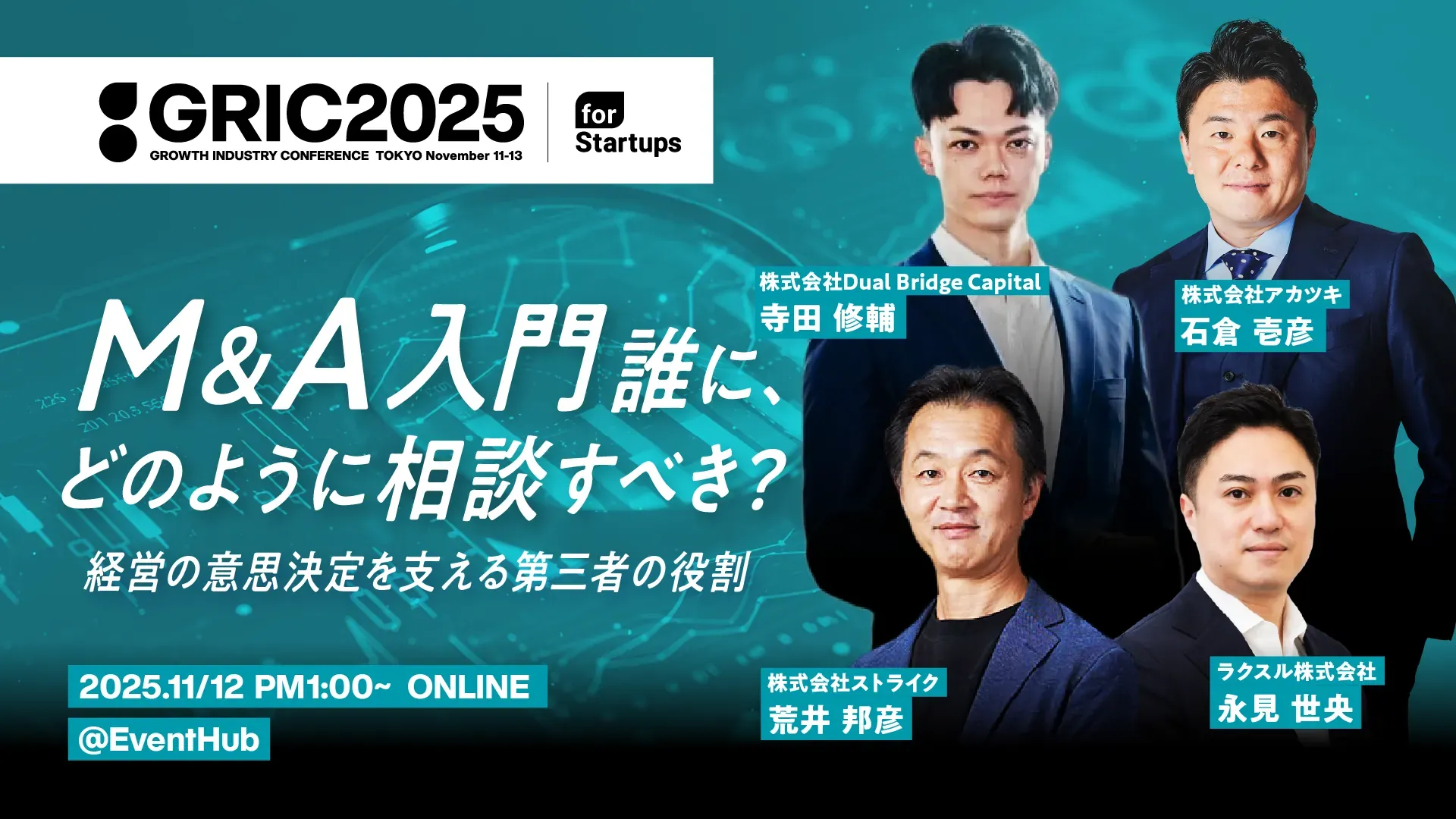

Startup M&A 101: Who Should You Consult, and How? – The Role of Trusted Third Parties in Decision-Making

An introduction to startup M&A. Who should you consult—VCs, accountants, advisors—and how? How can the decisions of often-isolated founders be supported? M&A experts, experienced entrepreneurs, and investors will share candid insights based on real experience, discussing the secrets of successful M&A, how to interpret VC advice, and the real conflicts and behind-the-scenes realities.

Kazuhiko Toyama vs. Founders Going Global: Vol.2

The second installment of the popular session where Kazuhiko Tomiyama engages with dynamic entrepreneurs and CEOs. This time, Inada from Andpad, Serizawa from SmartHR, and Maekawa from LOIVE join the discussion. Tomiyama candidly challenges the three fast-growing leaders in Vertical SaaS, Horizontal SaaS, and B2C on topics such as “what lies beyond growth,” “changes in industry structure,” and “the resolve of a CEO.” Through this thrilling debate on business strategy, organizational theory, and management philosophy, the session offers all leaders new perspectives and a call to action.

What Drives Disruptive Growth? Is “Purpose” Essential for Building Businesses and Teams?

Is having a “mission-driven purpose” necessary in startup management? While it may sound idealistic when daily KPIs dominate, it is essential for overcoming growth barriers and recruitment challenges. In this session, experts discuss how a founder’s purpose connects to concrete management activities such as hiring, fundraising, and organizational culture. The session explores why a clear mission can become a practical and valuable management resource.

Is Domestic Success Enough? What It Takes to Truly Scale Globally

Succeeding at home doesn’t guarantee true scale. So what do global investors look for when they say, “This company can win worldwide”? From market selection and timing to team building and product design — this session dives into the key perspectives startups need to compete on the global stage, shared by investors who operate at the forefront.

Redefining Exit: How Investors and Acquirers Shape Long-Term Value -----A Global Perspective Japan Must Embrace

"While IPOs remain the main path in Japan, startup exits are taking on increasingly diverse forms around the world. This session explores how global investors and acquirers are redefining exits as a strategic process for long-term value creation—and what that means for Japan’s next stage of growth."

In an era of intensifying technological rivalry between nations, “economic security” and “technological sovereignty” have become top-priority agendas that will determine a country’s survival and the future of its industries. This session goes beyond conventional startup support to ask how startups can become the “invisible infrastructure” that underpins society and national security. From satellites, cybersecurity, and disaster resilience to drones and AI-driven autonomous control — the trend toward leveraging private advanced technologies in dual-use (civilian and military) applications is accelerating, moving away from traditional public procurement and large-corporate-led development models. Speakers include Mr. Taki of Kearney, who brings a global view of industrial transformation; Mr. Kobayashi of the Liberal Democratic Party, who is active on the front lines of economic security policy; Mr. Kajita of Singular Perturbations, who aims to build the next-generation infrastructure; and Mr. Tokushige of Terra Drone, challenging the world with drone technology. Combining deep perspectives from both policy and industry, the panel will thoroughly examine the real challenges startups face within this vast tide and the strategies Japan should adopt.

"I want to consult about financing, but how much will they really trust my business plan?” “I’d like to explore a partnership, but I can’t read what the person across the table is really thinking.” For many startups, banks are among the most familiar and yet most challenging partners to navigate. This session is a deep dive discussion aimed at bridging the divide between startups and banks. When is the right timing and approach to negotiate debt financing? Beyond loans, how can startups tap into a bank’s assets such as its customer network and credibility to drive business growth? And what do banks truly expect from startups, and what concerns are they not voicing? This session moves beyond textbook finance and polished case studies to reveal real world frustrations, behind the scenes negotiations, and practical insider know-how — openly shared by both startups and bankers. For every CEO and CFO looking to turn their bank relationship from a funding option into a lever for strategic growth, this is a must attend session.

Against the backdrop of a rapidly changing global landscape and accelerating technological innovation, Japan's startup ecosystem is reaching a critical inflection point. What are the latest investment trends, global developments, Japan's competitive advantages, and the indispensable strategies for pioneering the future, as observed by Japan's leading venture capitalists? Incorporating key trends for 2025–2026, they will offer sharp perspectives on the future of Japanese industry and the economy.

When startup founders begin considering M&A as part of their growth journey, many are unsure who to turn to — and how. With so many players involved — VCs, tax advisors, M&A specialists — it’s not always clear where to begin. As an entrepreneur facing tough and often solitary decisions, who should you really seek advice from? What kind of input matters most? Or do you even need outside advice at all? In this session, four key figures from across Japan’s startup ecosystem will take on this fundamental question with honesty and insight. You’ll hear from M&A experts who have been on the front lines of countless deals, entrepreneurs who have leveraged M&A and investment to unlock non-linear growth, and investors who have guided many founders through high-stakes decisions. What makes for a successful M&A outcome? How should founders interpret advice from their VCs or shareholders? Drawing from firsthand experience, the speakers will unpack the real tensions behind the headlines, and the pivotal moments when external perspectives reshaped a company’s future. If you’re thinking seriously about M&A — a force that will shape the future of Japan’s startup ecosystem — this is a session you can’t afford to miss.

The second installment of the popular GRIC session series "vs," where Kazuhiko Toyama, a leader in Japan's industrial transformation, confronts some of the most dynamic entrepreneurs and business executives of today. This time, the challengers are Mr. Inada of ANDPAD, who is spearheading the DX (Digital Transformation) of the massive traditional construction industry; Mr. Serizawa of SmartHR, a SaaS powerhouse revolutionizing the Japanese way of working; and Mr. Maekawa of LOIVE, who is creating a fervent nationwide community through the real-world business of hot yoga. Against these three individuals achieving discontinuous growth in different fields—Vertical SaaS, Horizontal SaaS, and B2C services—Mr. Toyama will sharply and unreservedly pose fundamental questions, such as: "What do you envision beyond that growth?" "How are you trying to change the structure of Japanese industry through your business?" and "Where lies your 'true resolve' as a business executive?" Through this thrilling discussion where ideals and reality collide—covering business strategy, organizational theory, and management philosophy—new perspectives and a renewed sense of resolve will be thrust upon all leaders bearing the future of Japan.

For startup founders who are constantly chasing daily KPIs and managing cash flow, this question may sometimes sound like a distant ideal. However, when a company’s growth hits a wall or when top talent is drawn to an organization, at the heart of it almost always lies the founder’s unwavering “aspiration”. In this session, professionals from various perspectives will confront this straightforward question head-on. We will thoroughly discuss how “aspiration” is not merely a matter of philosophy, but is concretely linked to key business activities such as recruitment, fundraising, and organizational culture. Through this discussion, participants will explore why “aspiration” can serve as an indispensable, practical management resource in modern business.

While many startups achieve traction in their home markets, true scale often demands more than domestic success. Global investors consistently look for signals that a company can break out of local boundaries and compete internationally. In this session, leading investors will share candid insights on why relying solely on domestic markets may limit growth potential, and what differentiates startups that successfully expand across borders. From identifying the right timing and markets, to building teams and products that resonate globally, we’ll explore the critical factors that define whether a company can truly scale on the world stage.

For startups, an “exit” marks the next stage of growth. But is it truly an ending—or the beginning of something new? While IPOs remain the dominant path in Japan, global markets are seeing a broader range of approaches that nurture long-term startup value. In this session, global investors and strategic acquirers will discuss how the concept of “exit” is being redefined—not as a transactional goal, but as a strategic process that creates enduring value. Including IPOs, there is no single path to growth. How can startups choose the right direction and design their future for lasting impact? This session explores that perspective.

The above information is subject to change without notice.